目录

import pandas as pd

import numpy as np

from matplotlib import pyplot as plt

from sklearn.preprocessing import MinMaxScaler

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense, Dropout, LSTM

# 数据加载和预处理

gstock_data = pd.read_csv(r'D:\lstm-cnn\lstm-snn\000001_SZSE.csv')

gstock_data = gstock_data[['date', 'open', 'close']]

gstock_data['date'] = pd.to_datetime(gstock_data['date'])

gstock_data.set_index('date', drop=True, inplace=True)

# 数据缩放

scaler = MinMaxScaler()

scaled_data = scaler.fit_transform(gstock_data)

scaled_df = pd.DataFrame(scaled_data, index=gstock_data.index, columns=gstock_data.columns)

# 划分训练集和测试集

training_size = int(len(scaled_df) * 0.50)

train_data = scaled_df.iloc[:training_size]

test_data = scaled_df.iloc[training_size:]

# 创建序列和标签

def create_sequence(dataset, seq_length=50):

X, y = [], []

for i in range(len(dataset) - seq_length):

X.append(dataset.iloc[i:i + seq_length][['open', 'close']].values)

y.append(dataset.iloc[i + seq_length][['open', 'close']].values)

return np.array(X), np.array(y)

train_seq, train_label = create_sequence(train_data)

test_seq, test_label = create_sequence(test_data)

# 重塑输入数据以符合LSTM的输入要求 [samples, time steps, features]

train_seq = np.reshape(train_seq, (train_seq.shape[0], train_seq.shape[1], 2))

test_seq = np.reshape(test_seq, (test_seq.shape[0], test_seq.shape[1], 2))

print("Train sequence shape:", train_seq.shape)

print("Test sequence shape:", test_seq.shape)

# 构建和训练模型

model = Sequential()

model.add(LSTM(units=50, return_sequences=True, input_shape=(train_seq.shape[1], train_seq.shape[2])))

model.add(Dropout(0.1))

model.add(LSTM(units=50))

model.add(Dense(2)) # 假设输出是'open'和'close'价格

model.compile(loss='mean_squared_error', optimizer='adam')

model.fit(train_seq, train_label, epochs=80, batch_size=32, validation_data=(test_seq, test_label), verbose=1)

# 预测并逆变换结果

test_predicted = model.predict(test_seq)

test_inverse_predicted = scaler.inverse_transform(test_predicted)

seq_length = 10 # 假设你想要跳过前10个数据点

test_data_inverse = scaler.inverse_transform(test_data.values[seq_length:])

# 考虑到seq_length,确保索引对齐

predicted_index = test_data.index[seq_length:seq_length + len(test_predicted)]

# 创建包含预测和实际数据的DataFrame

gs_slic_data = pd.DataFrame(test_inverse_predicted, columns=['open_predicted', 'close_predicted'],

index=predicted_index)

test_data_inverse = scaler.inverse_transform(test_data.iloc[seq_length:].values)

# 假设 test_predicted 是你的模型预测结果,test_data_inverse 是逆变换后的测试数据

# 确定预测结果的长度

predicted_length = len(test_predicted)

# 裁剪 test_data_inverse 以匹配预测结果的长度

# 注意,我们已经跳过了前 seq_length 个数据点,因此从 seq_length 开始裁剪

test_data_inverse_cropped = test_data_inverse[:predicted_length, :]

# 现在你可以将裁剪后的数据添加到 gs_slic_data DataFrame 中

gs_slic_data[['open_actual', 'close_actual']] = test_data_inverse_cropped[:, :2]

# 绘制实际与预测的价格对比图(仅绘制'open'价格作为示例)

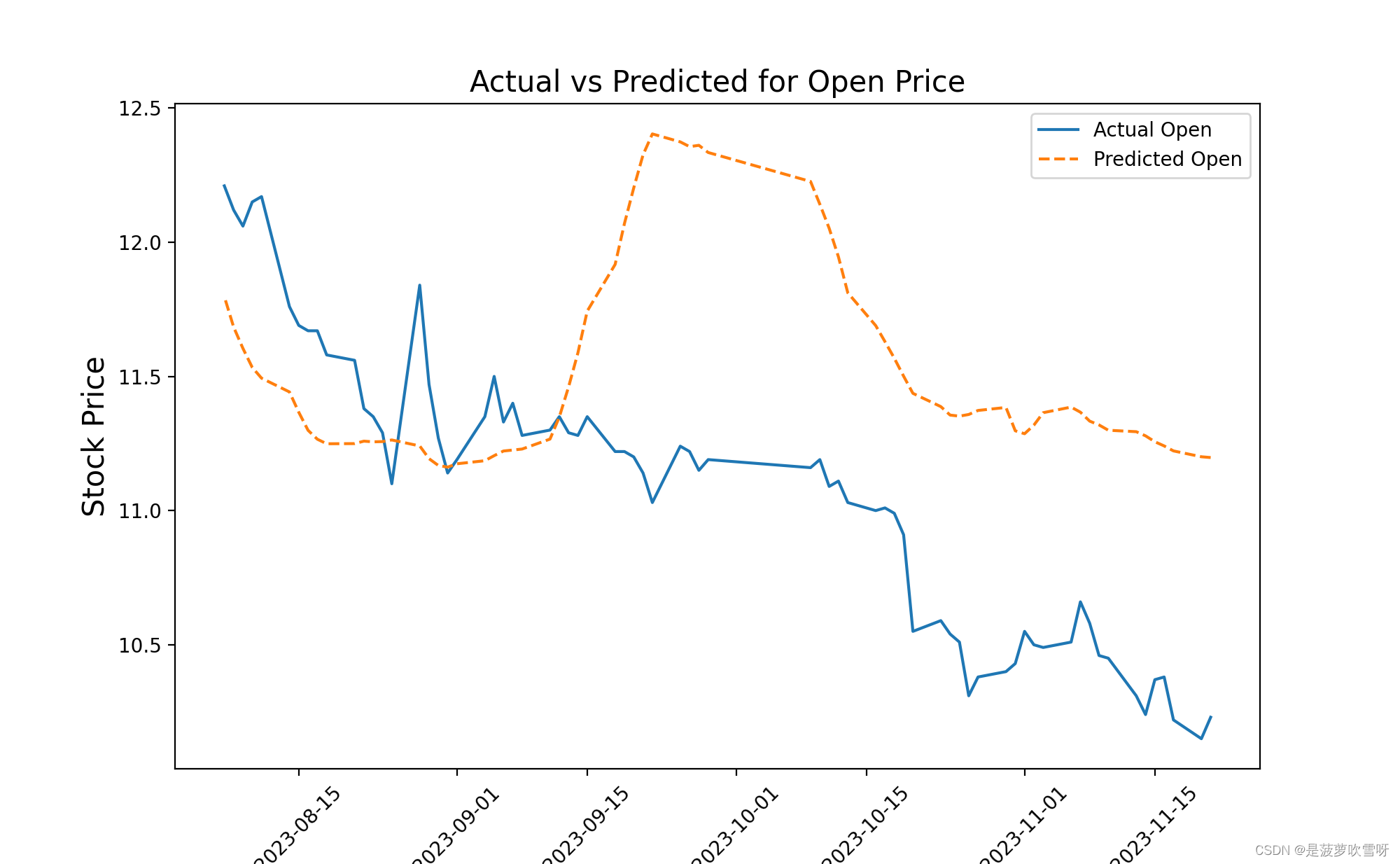

plt.figure(figsize=(10, 6))

plt.plot(gs_slic_data.index, gs_slic_data['open_actual'], label='Actual Open')

plt.plot(gs_slic_data.index, gs_slic_data['open_predicted'], label='Predicted Open', linestyle='--')

plt.xticks(rotation=45)

plt.xlabel('Date', size=15)

plt.ylabel('Stock Price', size=15)

plt.title('Actual vs Predicted for Open Price', size=15)

plt.legend()

plt.show()